Q Intel Brief - 10.20.22

GM anon,

Here is a TLDR of what we have for you today:

The TVL story across chains

Defi blue chips performance tracked

No rescue for NFTs

Drop in Bitcoin and S&P 500 correlation

Top 5 profitable Web3 dApps

Mango Markets REKT for $115M

Viral Web2 vs Web3 meme

Stats 📈

The State of DeFi 🏛️

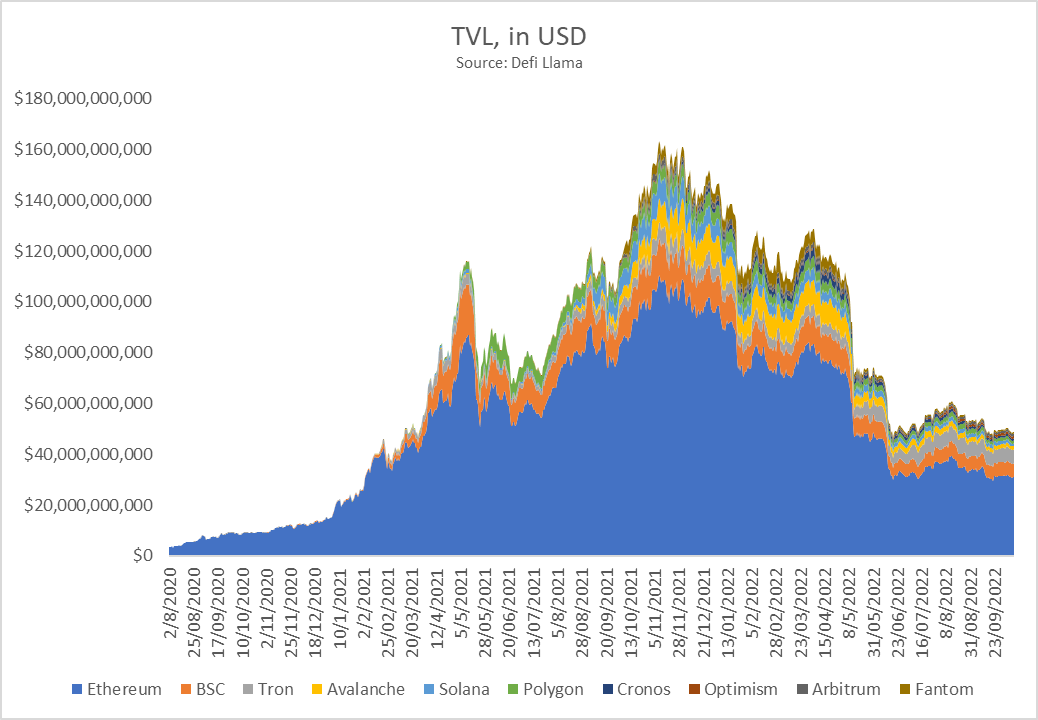

Below is a historical chart of TVL of the top 10 chains, in USD, from Defi Llama:

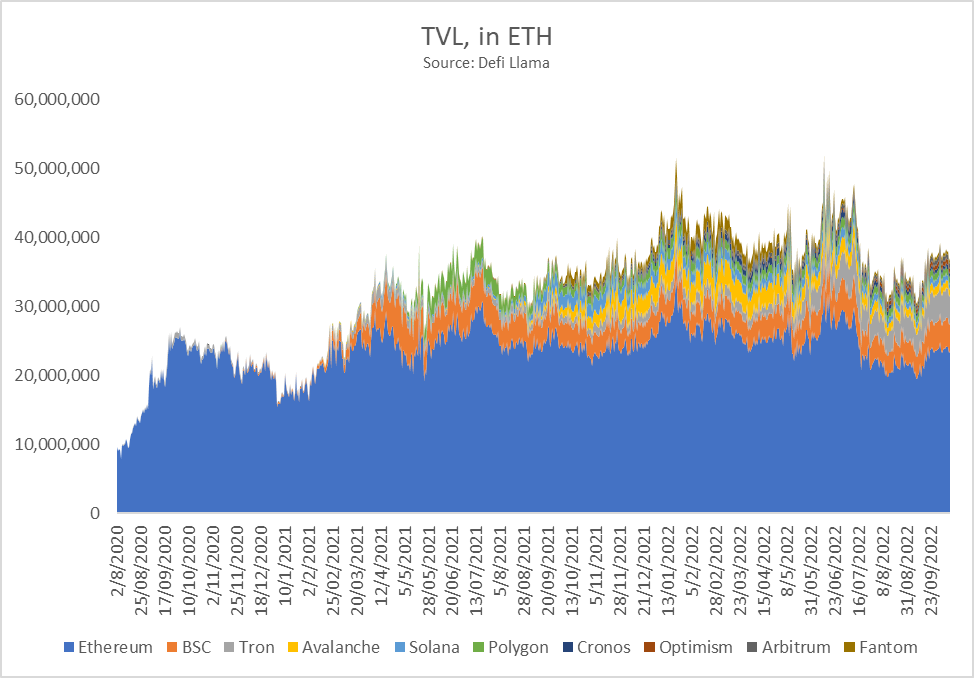

And in terms of ETH:

Similar to the last newsletter, TVL (USD) seems to have found a bottom in recent weeks, while TVL (ETH) is starting to pick back up post-Merge.

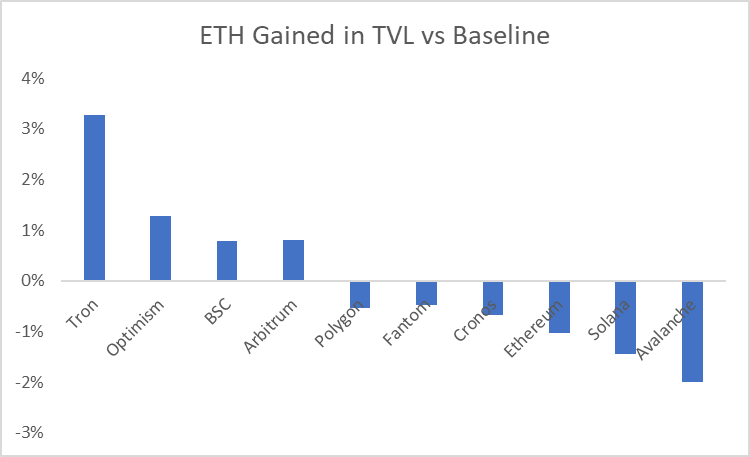

Besides Ethereum moving up the rankings from last to third-to-last, not much has changed here. Optimism and Arbitrum look strong, making up nearly 36% of all transactions on Ethereum.

DeFi Protocol Comparisons 📊

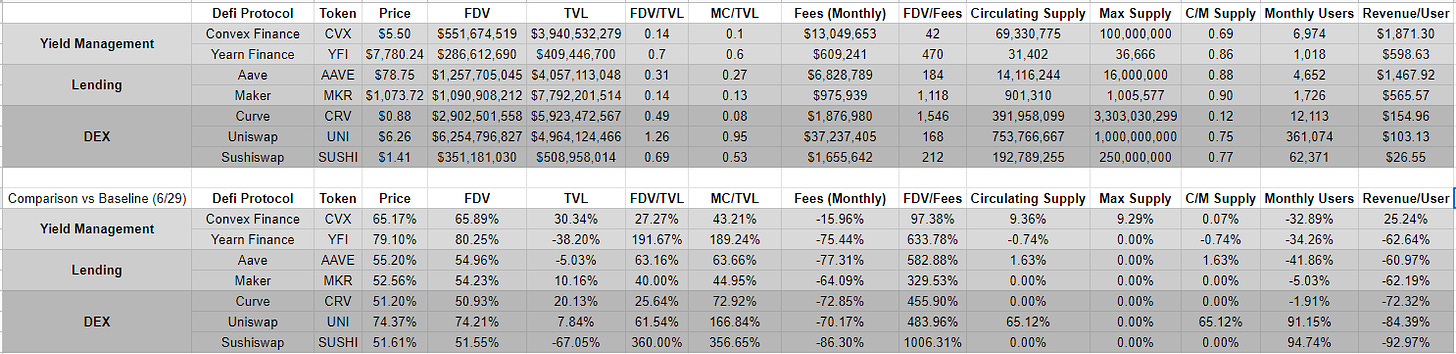

Besides price, market cap, etc., there isn’t much available in terms of valuing DeFi protocols. We’re introducing a few advanced metrics to help with that, starting with these DeFi protocols. An overview of the metrics:

FDV/TVL - Fully diluted value divided by total value locked. This fraction intends to show relative value. A low market cap with high TVL (usage) will signal value, and a high fraction means the protocol is relatively overvalued.

FDV/Fees - This multiple also displays a ratio of value to usage, this time with fees collected by the protocol. Similar to the above, a protocol with relatively low FDV and high fees will be undervalued.

C/M Supply - The proportion of circulating to max supply shows which protocols will stand to be diluted the most in the future. In bear markets, it’s extra hard to gain market share when token unlocks flood the market.

Revenue/User - The fees generated per user show which protocols have the most to gain from further adoption.

In this newsletter, we’re adding to the list a Market Cap/TVL metric which is a twisted take of the FDV/TVL metric we already have. Market Cap/TVL is more of a “current” valuation, while FDV/TVL is more of a “future” valuation. Including these two will give a sense of the current sentiment vs. the future sentiment of a project.

The State of NFTs 🖼️

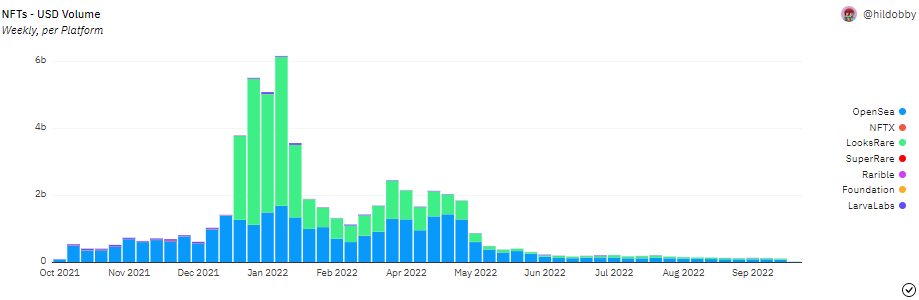

NFT weekly volumes in USD terms are still extremely low and not showing signs of picking up

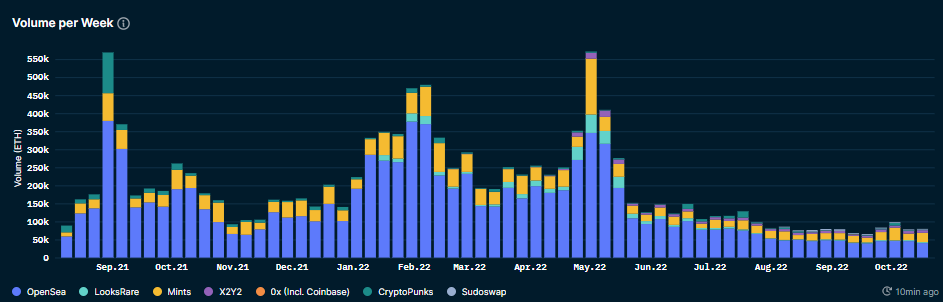

The story in terms of ETH volume tells a similar (but not as drastic) story, showing small signs of life recently:

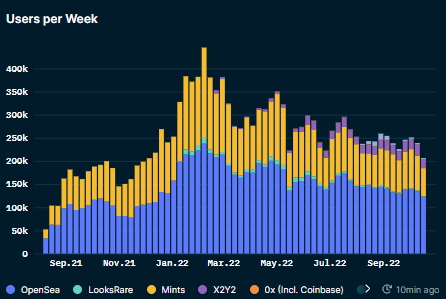

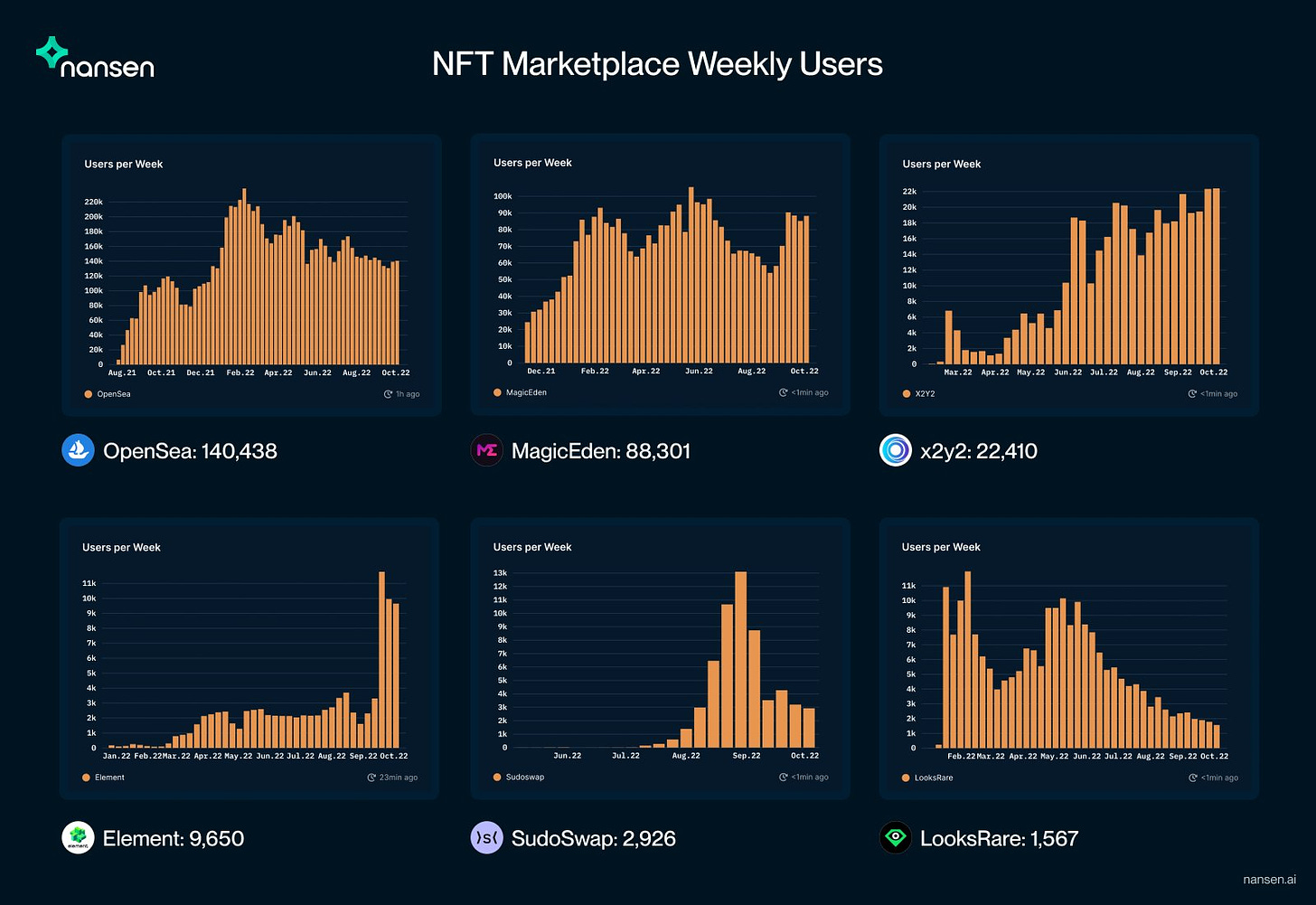

Weekly users, on the other hand, have decreased from the peak but are only down ~49% from the top:

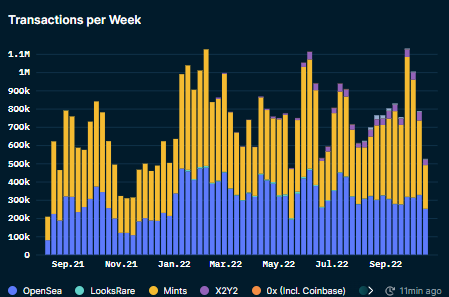

Besides the recent spike in transactions, things still seem to be pretty stagnant here too:

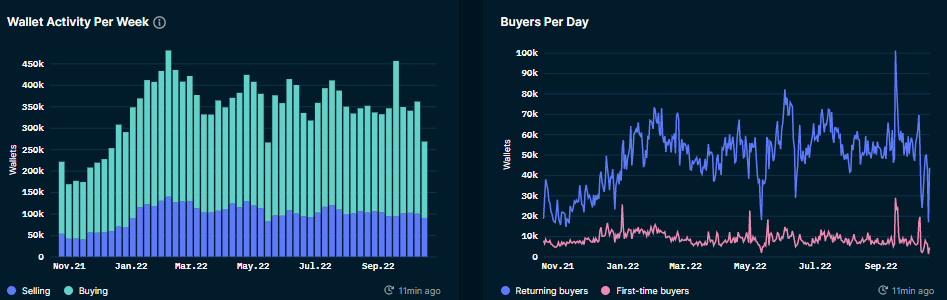

Wallet activity and buyers have dropped off recently too:

The Nansen Blue Chip-10 Index spiked recently and has fallen back down, but seems to be showing a small/slight uptrend since September still:

The broader market NFT-500 is experiencing a similar trend. It is interesting to note the YTD change in USD between the blue chips and the rest of the market is very similar (-69% vs -74%). This speaks to how depressed the market is that everything is down similarly.

Looking at NFT exchanges, we can see who is trending up/down:

State of the Crypto Market💹

Macro Backdrop

The correlations between BTC and the broader equity markets have dropped even further down to 0.23 (down from 0.28) with the S&P 500 and 0.18 (down from 0.22) with QQQ. Over the past two months, SPY and QQQ are down ~9-11% each, while BTC is down only ~2%- a very small sample size, but definitely, one to watch.

Updates on the key meetings/timeline looking forward:

The Atlanta FED is still forecasting fairly high GDP growth in Q3 - 2.8%, up from 2.7% last newsletter.

The Oct 13 inflation print came in slightly hotter than expected, locking in expectations for another 75 bps rate hike during the next FOMC meeting.

The inflation forecaster from the Cleveland FED is predicting another month-over-month CPI increase. With Q4 2021 seeing a large bump in CPI ratings, continuing into Q1 2022, we expect YoY inflation to peak and start declining over the next 6 months. MoM inflation will likely start showing signs of flattening/decreasing soon after.

QT Update

How is QT going? The FED claimed to target removing ~$47.5bn in total assets per month, starting June 1, for three months before ramping up to $95bn per month thereafter.

Assets (in millions of USD) on June 1, 2022, were 8,915,050. Assets as of October 12, 2022, were 8,758,969, meaning $156bn of the targeted ~$290bn has been removed so far:

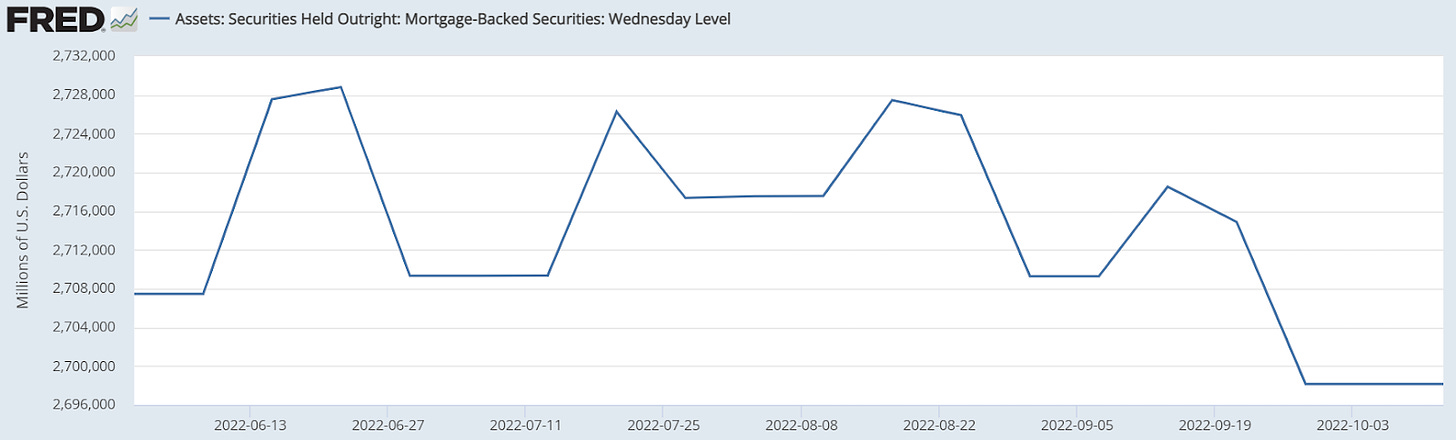

Mortgage-backed securities, theoretically propping up the real estate market, have finally started to be sold off, albeit very slightly:

Bitcoin Backdrop ₿

In the last newsletter, we showed how 9 of the most popular on-chain metrics pointed to oversold/potential bottoming signs. Those signs are all still in place, with updated data below:

The Mayer Multiple is still bouncing up higher from its 3rd lowest reading in the last ten years.

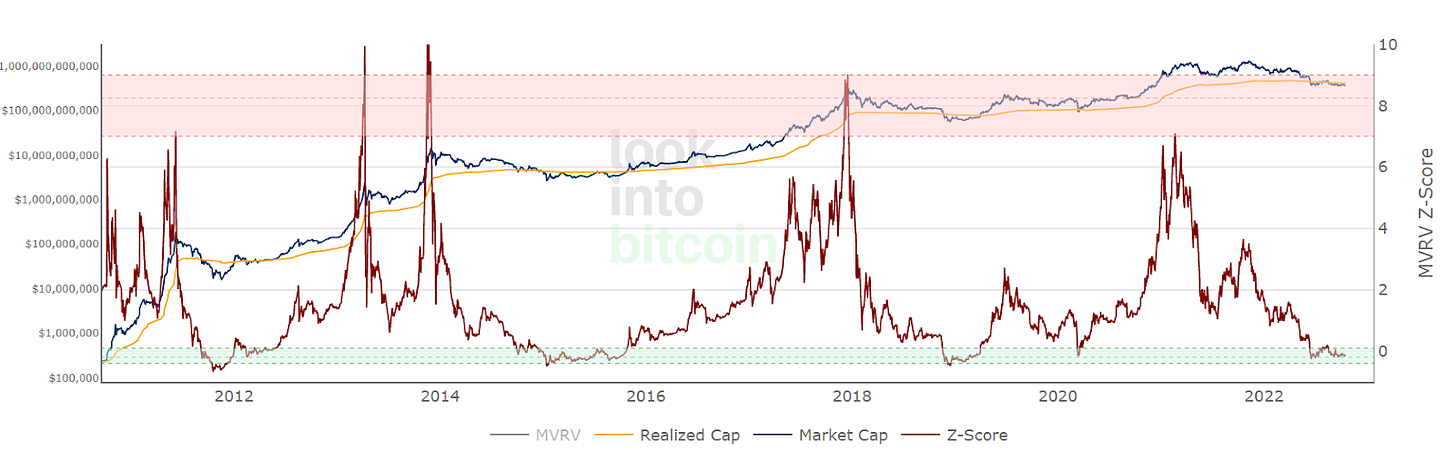

The MVRV Z-score is still in the green accumulation zone:

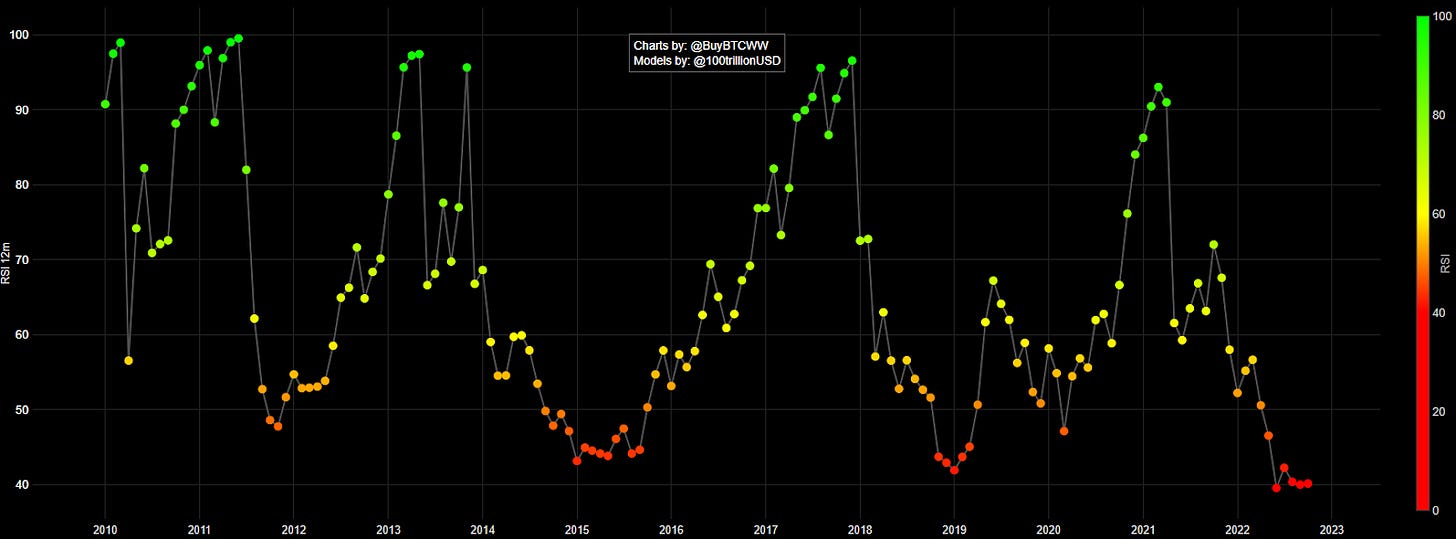

Bitcoin's monthly RSI is still at all-time low readings:

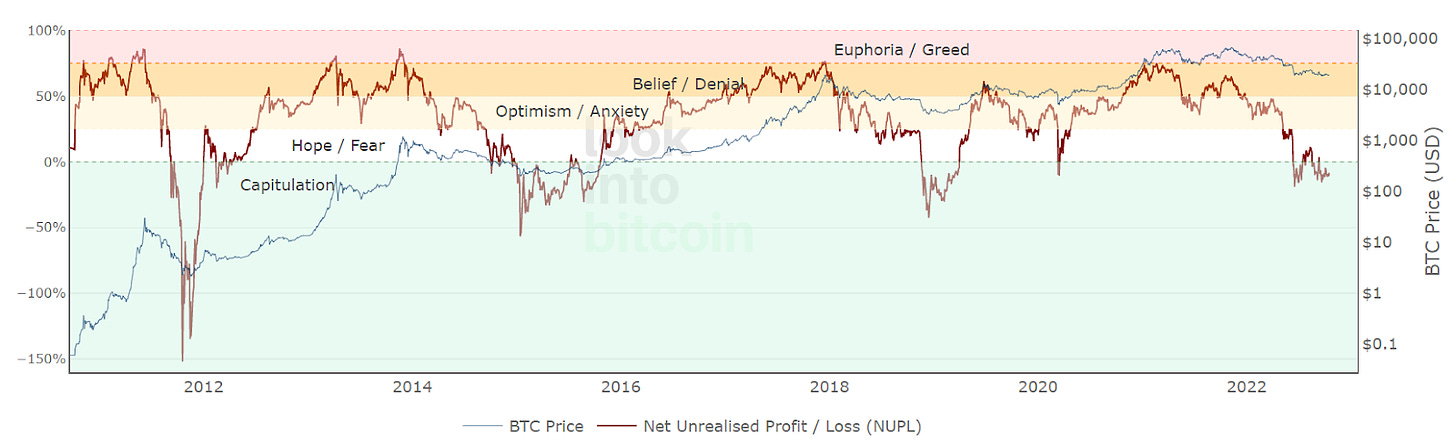

Net Unrealized P/L is back in the accumulation zone too:

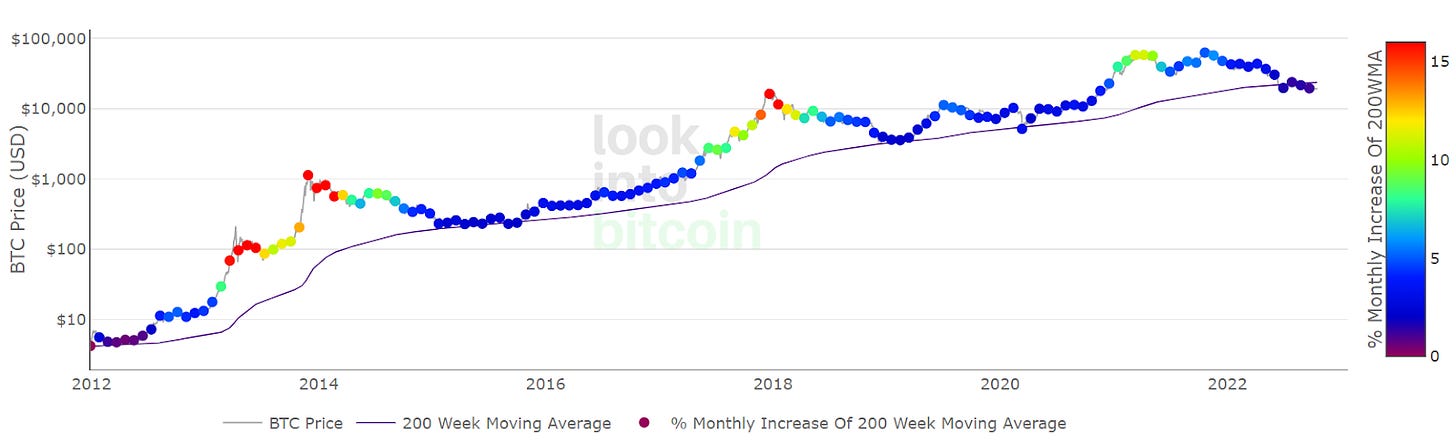

Bitcoin price is still below its 200-week moving average and is having trouble breaking above it - will this act as a new resistance?

Reserve Risk is still in the accumulation zone. Could it break below for the first time?

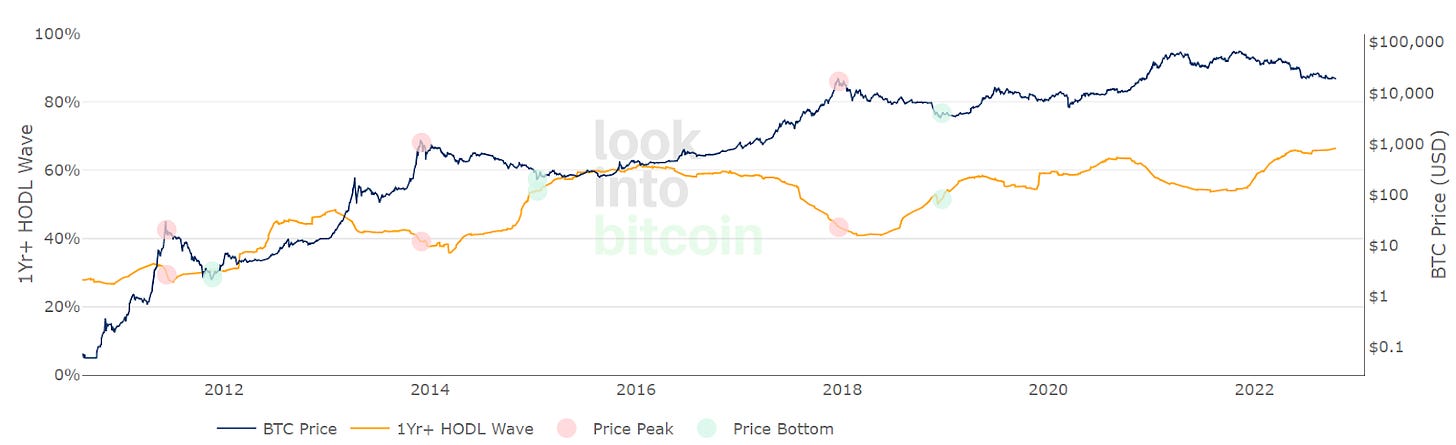

The one-year hodl wave is STILL flat at ATH.

The Hash Ribbons and Bitcoin Production Costs are showing value. As hash power increases, the cost of producing Bitcoin also increases, providing a floor that is increasing:

News 🗞️

Crypto 🪙

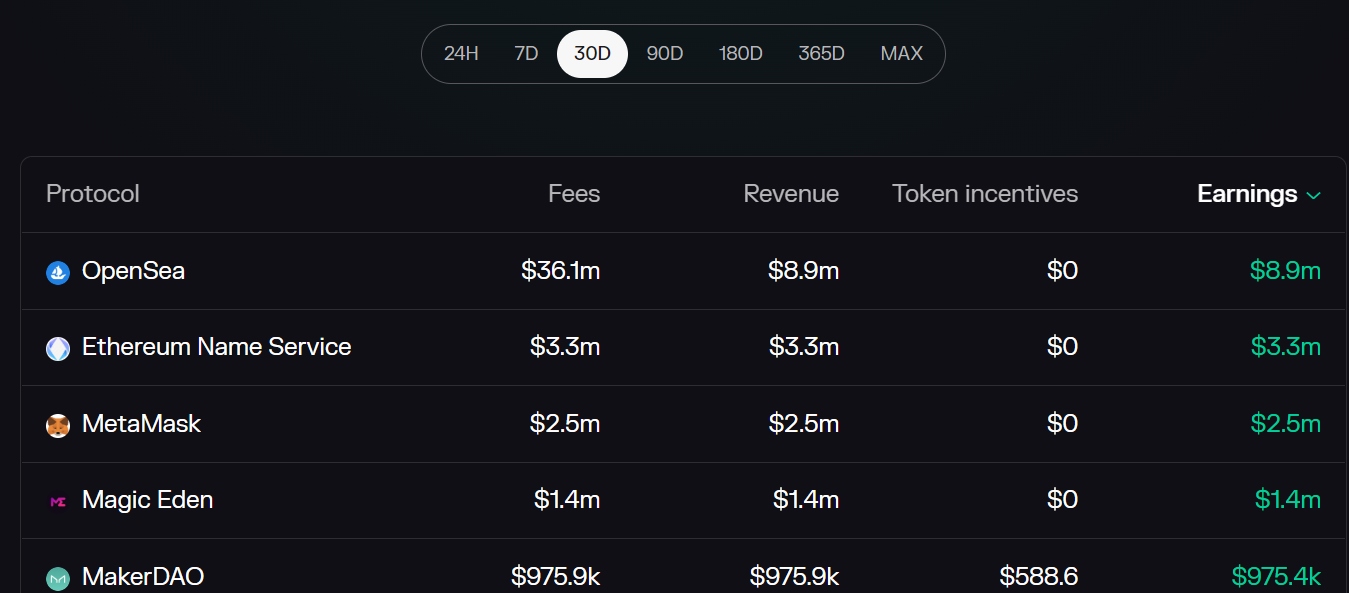

Updating the Token Terminal Earnings leaderboard:

Sushiswap hired a new Head Chef and the markets seemed to approve, with the price up 20% since the news

The SEC announced investigations into Yuga Labs on the distribution of the Ape Coin, something this newsletter predicted from the onset.

A French state-owned energy company is managing over 150 Ethereum nodes.

Janet Yellen & OFAC Director Sued Over Tornado Cash Sanctions

Tether is buying US T bills

A Binance Smart Chain validator was exploited to mint unbacked BNB. The attacker was able to bridge ~$100 million off-chain before chain operators coordinated a pause.

Temple DAO was exploited for ~$2mm

Google now supports data on Ethereum addresses, using Etherscan to retrieve data.

Lesser known hacks - Rabby wallet was exploited, QANplatform bridge was exploited, and the Paraswap deployer address was compromised

Eth 2.0

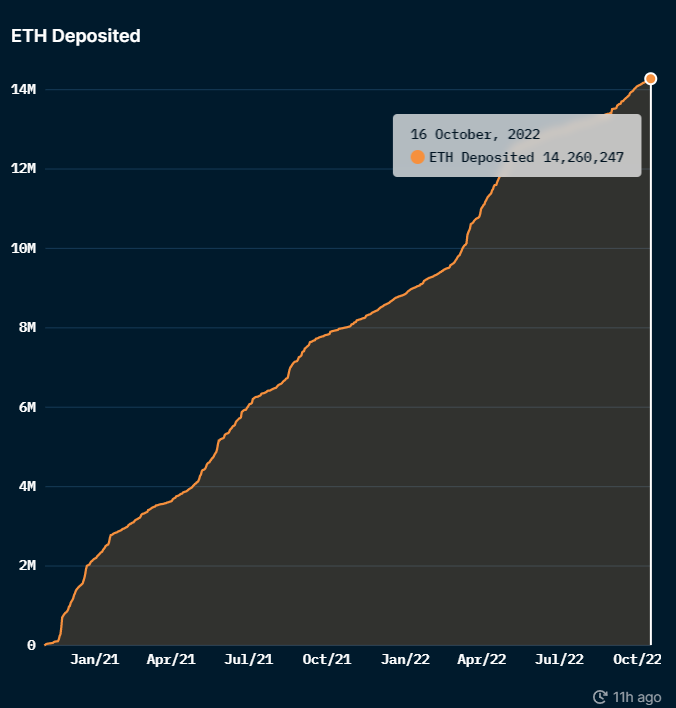

Deposits to the ETH2 deposit contract are still increasing post-Merge:

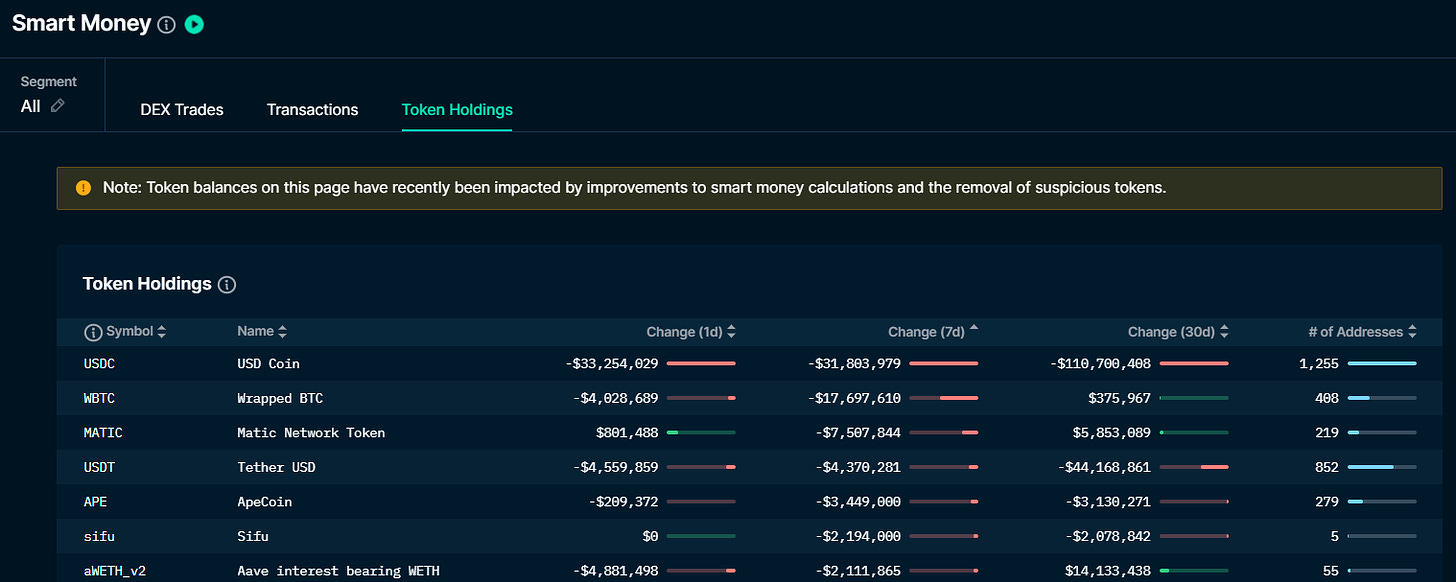

Smart Money token holdings over the last 7 days:

Trends ⚡

Highest-grossing NFT 💎

CryptoPunk #8958

Last sale price: 0.6 ETH ($795.2)

Floor price: 65.58 ETH ($88,241)

Estimated price: 285.59 ETH ($381,963.62)

Last week, Punk #2924 was sold for 333 ETH ($426,170), which is 5X the floor price of the collection. This pixelated avatar belongs to the type Ape, only 0.24% have this trait, and comes with a hoodie as its accessory, which is only found in 3% of all NFTs from this collection.

No matter where the markets are going, Punks are never out of fashion!

REKT 💸

Mango Markets

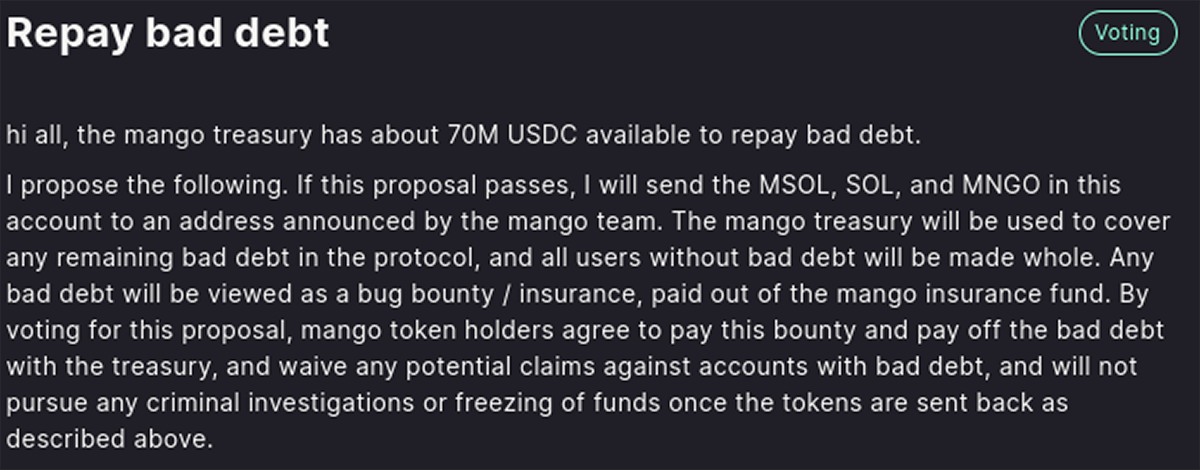

Last week, Solana’s flagship margin trading protocol got rekt, losing 9 figures ($115M) to a well-funded market manipulator.

The attacker managed to spike the price of Mango Markets’ native token MNGO and drain their lending pools, leaving the protocol with $115M of bad debt. The team was trying hard to reach some sort of agreement with the exploiter.

In a recent update, it was confirmed by the Mango team that $67M in various crypto assets have been returned to the DAO.

Strangely, the Mango team was less keen to offer a bounty when the issue was raised via the project’s Discord back in March.

Read the detailed report here.

After seeing the ongoing bloodbath, just like CREAM, DeFiers have developed a bad taste for Mangoes too!

Buzzword 🌐

Aptos - Aptos is a Layer 1 blockchain founded by ex-Facebook employees who received unicorn money from Andreessen Horowitz and other prominent web3 investors like 3 Arrows Capital, FTX Ventures, and Coinbase Ventures.

The buzz has been mainly around its mainnet launch and the airdrop of APT tokens to early network participants.

You can learn more about it here.

Meme 💩

Have you ever wondered what’s it like when a web 2 founder meets a web 3 founder? Luckily, we have one such meeting captured for you on camera.

Thank you for reading,

The Q team